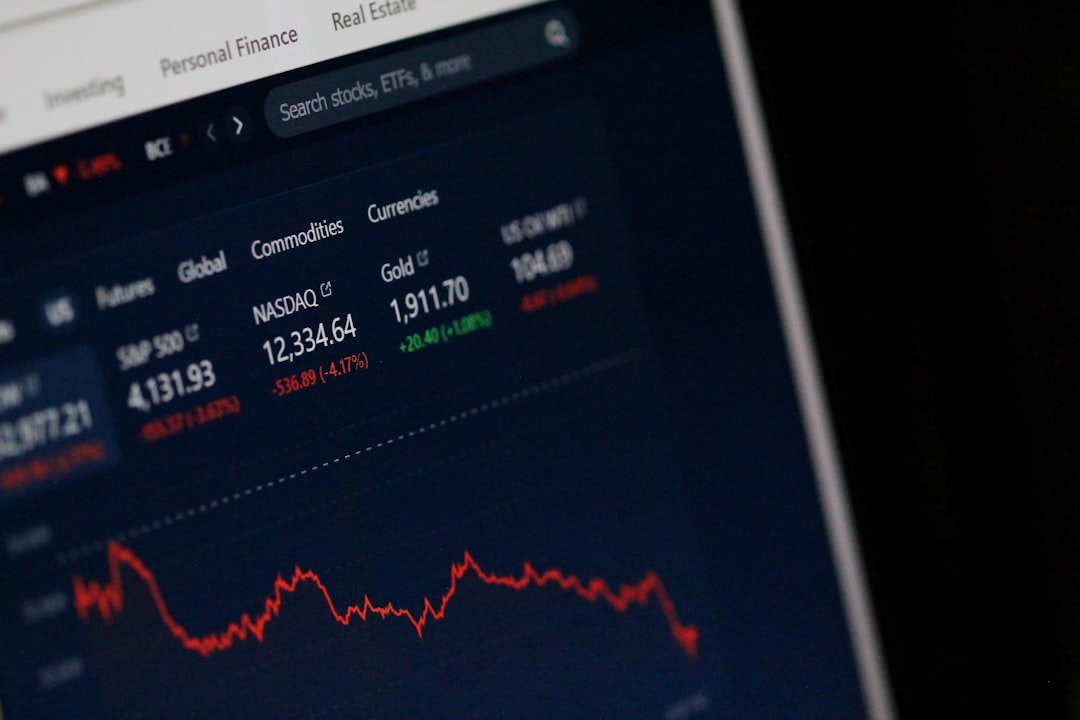

At the heart of investing lies the fundamental relationship between risk and return. Risk refers to the potential for loss or the uncertainty surrounding the future performance of an investment, while return is the profit or income generated from that investment. Investors must recognize that higher potential returns typically come with higher levels of risk.

For instance, stocks, which can offer substantial long-term gains, are generally more volatile than bonds, which provide steadier, albeit lower, returns. This inherent trade-off necessitates a careful evaluation of one’s risk tolerance—an individual’s ability and willingness to endure fluctuations in investment value. Understanding this dynamic is crucial for making informed investment decisions that align with personal financial goals.

Moreover, the concept of risk extends beyond mere volatility; it encompasses various dimensions, including market risk, credit risk, and liquidity risk. Market risk pertains to the overall fluctuations in the financial markets that can affect the value of investments, while credit risk involves the possibility that a borrower may default on a loan or bond. Liquidity risk refers to the difficulty of selling an asset without incurring significant losses.

Investors must assess these risks in conjunction with their expected returns to create a balanced portfolio that reflects their financial objectives and comfort levels. By comprehensively understanding risk and return, investors can make strategic choices that enhance their chances of achieving long-term financial success.

Key Takeaways

- Understanding Risk and Return: It is important to understand the relationship between risk and return when making investment decisions.

- Diversification: Diversifying your investment portfolio is key to minimizing risk and maximizing returns.

- Investing for the Long Term: Long-term investing can help you ride out market fluctuations and achieve your financial goals.

- Utilizing Tax-Efficient Investment Strategies: Implementing tax-efficient investment strategies can help maximize your after-tax returns.

- The Importance of Regular Portfolio Rebalancing: Regularly rebalancing your portfolio can help maintain your desired asset allocation and manage risk.

Diversification: The Key to Minimizing Risk

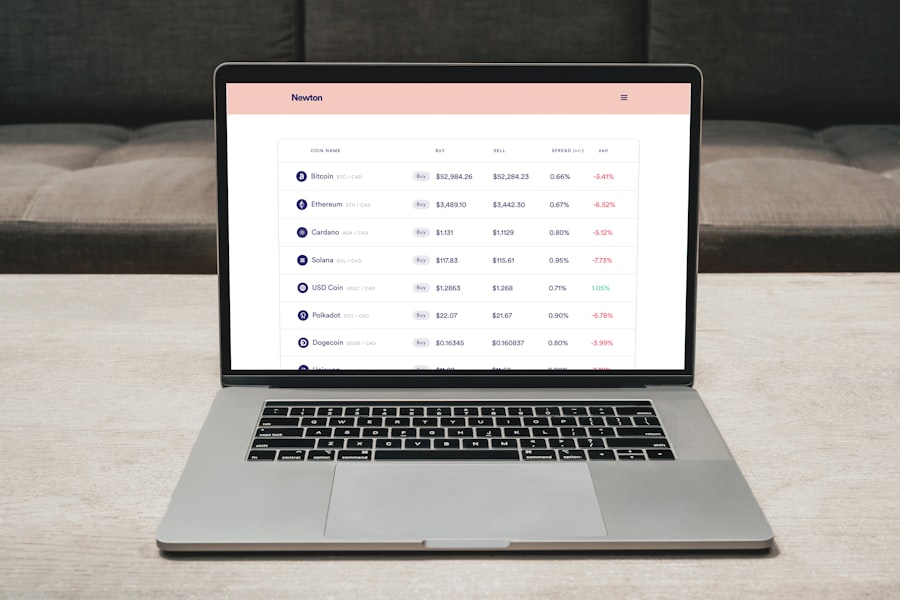

Diversification is a fundamental strategy employed by investors to mitigate risk while aiming for optimal returns. The principle behind diversification is simple: by spreading investments across various asset classes, sectors, and geographic regions, investors can reduce the impact of any single investment’s poor performance on their overall portfolio. For example, if an investor holds stocks in multiple industries—such as technology, healthcare, and consumer goods—poor performance in one sector may be offset by gains in another.

This not only helps to stabilize returns but also lowers the overall volatility of the portfolio, making it less susceptible to market fluctuations. In addition to asset class diversification, investors can also consider diversifying within asset classes. For instance, within a stock portfolio, one might include a mix of large-cap, mid-cap, and small-cap stocks, as well as international equities.

Similarly, in fixed-income investments, incorporating government bonds, corporate bonds, and municipal bonds can provide a buffer against interest rate changes and credit risks. The key takeaway is that diversification does not eliminate risk entirely; rather, it helps to manage it effectively. By constructing a well-diversified portfolio tailored to individual risk tolerance and investment goals, investors can enhance their chances of achieving consistent returns over time.

Investing for the Long Term

Investing for the long term is a strategy that emphasizes patience and discipline in the face of market volatility. Historically, markets have shown a tendency to recover from downturns over extended periods, rewarding those who remain invested rather than attempting to time the market. Long-term investing allows individuals to ride out short-term fluctuations and benefit from the compounding effect of returns over time.

This approach is particularly relevant in equity markets, where short-term price movements can be influenced by a myriad of factors, including economic data releases and geopolitical events. By maintaining a long-term perspective, investors can focus on the underlying fundamentals of their investments rather than being swayed by temporary market sentiment. Additionally, long-term investing aligns well with the concept of goal-oriented financial planning.

Whether saving for retirement, funding a child’s education, or building wealth for future generations, having a long-term horizon allows investors to set realistic expectations and develop strategies that are conducive to achieving their objectives. It also encourages regular contributions to investment accounts, which can further enhance growth through dollar-cost averaging—a technique that involves investing a fixed amount regularly regardless of market conditions. By committing to a long-term investment strategy, individuals can cultivate financial resilience and increase their likelihood of reaching their financial milestones.

Utilizing Tax-Efficient Investment Strategies

| Investment Strategy | Tax Efficiency | Benefits |

|---|---|---|

| Index Funds | High | Diversification, low turnover, and low capital gains distributions |

| Municipal Bonds | High | Tax-exempt interest income for federal and sometimes state taxes |

| Tax-Managed Funds | High | Minimize tax impact through strategic buying and selling |

Tax efficiency is an essential consideration for investors seeking to maximize their after-tax returns. Different investment vehicles are subject to varying tax treatments, which can significantly impact overall profitability. For instance, long-term capital gains—profits from assets held for more than one year—are typically taxed at lower rates than short-term capital gains.

This distinction underscores the importance of holding investments for longer periods when possible to benefit from favorable tax rates. Additionally, tax-advantaged accounts such as Individual Retirement Accounts (IRAs) and 401(k) plans allow investors to defer taxes on earnings until withdrawal, further enhancing the growth potential of their investments. Moreover, strategic asset location can play a pivotal role in optimizing tax efficiency.

This involves placing tax-inefficient investments—such as bonds or actively managed funds that generate high turnover—within tax-advantaged accounts while keeping tax-efficient investments—like index funds or stocks—within taxable accounts. By doing so, investors can minimize their tax liabilities while maximizing their overall returns. Furthermore, employing tax-loss harvesting strategies—selling underperforming investments to offset capital gains—can also contribute to improved tax efficiency.

By being mindful of tax implications and employing effective strategies, investors can significantly enhance their net returns over time.

The Importance of Regular Portfolio Rebalancing

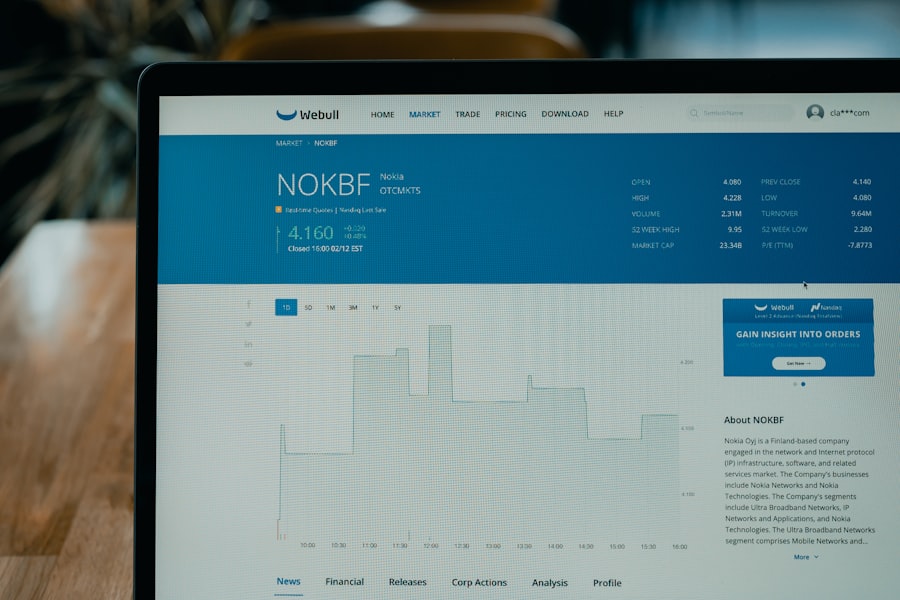

Regular portfolio rebalancing is a critical practice that helps investors maintain their desired asset allocation over time. As market conditions fluctuate and different asset classes perform variably, an investor’s portfolio may drift from its original allocation. For instance, if equities perform exceptionally well over a period while bonds lag behind, the proportion of stocks in the portfolio may become disproportionately high relative to bonds.

This shift can increase overall portfolio risk beyond what was initially intended. By periodically rebalancing—selling assets that have exceeded their target allocation and buying those that have underperformed—investors can realign their portfolios with their risk tolerance and investment objectives. In addition to maintaining desired asset allocation, rebalancing also presents an opportunity for disciplined investing.

It encourages investors to sell high and buy low—a principle that runs counter to emotional decision-making often seen during market fluctuations. By adhering to a systematic rebalancing schedule—whether quarterly or annually—investors can avoid the pitfalls of market timing and emotional trading decisions. This disciplined approach not only helps in managing risk but also enhances the potential for long-term returns by ensuring that portfolios remain aligned with strategic investment goals.

Harnessing the Power of Compound Interest

The concept of compound interest is often referred to as one of the most powerful forces in finance. It refers to the process where interest earned on an investment is reinvested to generate additional earnings over time. This exponential growth effect means that even modest initial investments can grow significantly over extended periods due to compounding.

For example, an investment of $1,000 earning an annual interest rate of 5% will grow to approximately $1,628 over ten years if left untouched—a testament to how compounding can amplify wealth accumulation. The earlier one starts investing, the more pronounced this effect becomes; thus, time is a crucial factor in harnessing the power of compound interest. Furthermore, compounding is not limited to interest-bearing accounts; it applies equally to investments in stocks and other assets that appreciate over time.

Reinvesting dividends from stocks or interest from bonds allows investors to purchase additional shares or units, thereby increasing their potential future earnings. This strategy underscores the importance of maintaining a long-term investment horizon; by allowing investments to compound over time without interruption from withdrawals or excessive trading, individuals can significantly enhance their wealth-building potential. Embracing compound interest as a core principle of investing can lead to substantial financial growth and security.

The Role of Asset Allocation in Maximizing Returns

Asset allocation is a strategic approach that involves dividing an investment portfolio among different asset categories such as stocks, bonds, real estate, and cash equivalents. The primary goal of asset allocation is to optimize the balance between risk and return based on an investor’s individual financial goals and risk tolerance. Research has shown that asset allocation decisions are often more influential on portfolio performance than individual security selection; thus, it becomes imperative for investors to carefully consider how they distribute their assets across various classes.

A well-thought-out asset allocation strategy not only helps manage risk but also positions investors to capitalize on different market conditions. Moreover, effective asset allocation requires ongoing assessment and adjustment as market dynamics change and personal circumstances evolve. For instance, an investor nearing retirement may shift towards a more conservative allocation with a higher proportion of bonds to preserve capital and generate income.

Conversely, younger investors with longer time horizons may favor equities for growth potential despite higher volatility. By regularly reviewing and adjusting asset allocations in response to changing market conditions and life stages, investors can better position themselves for maximizing returns while managing associated risks effectively.

Incorporating Alternative Investments into Your Portfolio

In recent years, alternative investments have gained popularity among investors seeking diversification beyond traditional asset classes like stocks and bonds. Alternatives encompass a wide range of assets including real estate, private equity, hedge funds, commodities, and even collectibles such as art or wine. These investments often exhibit low correlation with traditional markets; thus, they can provide valuable diversification benefits during periods of market turbulence.

For instance, real estate investments may perform well when stock markets are underperforming due to economic downturns or rising interest rates. By incorporating alternatives into their portfolios, investors can potentially enhance returns while reducing overall portfolio volatility. However, investing in alternative assets comes with its own set of challenges and considerations.

Many alternative investments are less liquid than traditional assets; they may require longer holding periods before realizing gains or may involve higher fees due to active management strategies. Additionally, thorough due diligence is essential when evaluating alternative opportunities since they often lack the transparency associated with publicly traded securities. Investors should carefully assess their risk tolerance and investment objectives before venturing into alternatives while ensuring they maintain a diversified approach across all asset classes.

By thoughtfully integrating alternative investments into their portfolios, individuals can create a more resilient investment strategy capable of weathering various market conditions while pursuing enhanced returns.

If you’re looking to deepen your understanding of investment strategies, it’s essential to consider various resources that can offer insights and detailed information. A particularly relevant article can be found on a comprehensive website dedicated to financial strategies. You can read more about different investment approaches and how to apply them effectively by visiting this link. This article provides valuable information that can help both novice and experienced investors refine their strategies and potentially increase their investment returns.

FAQs

What are investment strategies?

Investment strategies are the approaches and plans that investors use to allocate their funds in order to achieve their financial goals. These strategies can vary based on factors such as risk tolerance, time horizon, and investment objectives.

What are the different types of investment strategies?

There are various types of investment strategies, including buy and hold, value investing, growth investing, income investing, momentum investing, and diversification. Each strategy has its own unique approach to selecting and managing investments.

How do investment strategies differ based on risk tolerance?

Investment strategies can differ based on an individual’s risk tolerance. For example, a conservative investor may opt for a strategy that focuses on capital preservation and income generation, while an aggressive investor may choose a strategy that seeks higher returns through riskier investments.

What role does diversification play in investment strategies?

Diversification is a key component of many investment strategies. It involves spreading investments across different asset classes, industries, and geographic regions to reduce risk. Diversification can help mitigate the impact of market volatility on a portfolio.

How do investment strategies consider the time horizon of an investor?

Investment strategies take into account the time horizon of an investor, which refers to the length of time they plan to hold their investments. For example, a long-term investor may focus on strategies that aim for capital appreciation over several years, while a short-term investor may prioritize strategies that generate quick returns.

What are some common mistakes to avoid when implementing investment strategies?

Common mistakes to avoid when implementing investment strategies include not conducting thorough research, letting emotions drive investment decisions, failing to diversify, and not regularly reviewing and adjusting the strategy based on changing market conditions.